Is Two-Factor Authentication Hurting Your Mobile Banking UX?

April 08, 2025

“Practically every time I open it, it asks me to verify and sends texts.”

That’s a sample from a 2023 text analysis of thousands of mobile banking app reviews.

In that analysis, and in the real-world experience of the financial services companies that IronVest works with, login, authentication, and step-up authentication are easily among the top causes of UX friction (and negative reviews/customer churn).

The reality of mobile banking is that every day, millions of people attempt to make payments or bank on their phones, watches, or other devices and end up wanting to change banks because the experience they encounter is so frustrating.

Research from a national banking regulator showed that in 2024, 63% of banking customers were unsatisfied with their banking provider.

Here's the problem: traditional 2FA systems and the complex fraud prevention networks they're part of have created an unnecessary maze for users. What's worse, all this added complexity isn't even keeping pace with modern fraud trends.

So we're stuck in this frustrating middle ground where mobile banking is neither secure enough nor easy to use. But it doesn't have to be this way.

What's Really Getting in the Way of Better Banking UX

Digital teams responsible for mobile banking apps face a challenging balancing act. They know UX matters tremendously, but their primary responsibility is ensuring secure and compliant authentication at scale.

The problem is that the backend systems their mobile apps typically depend on are not up to the task.

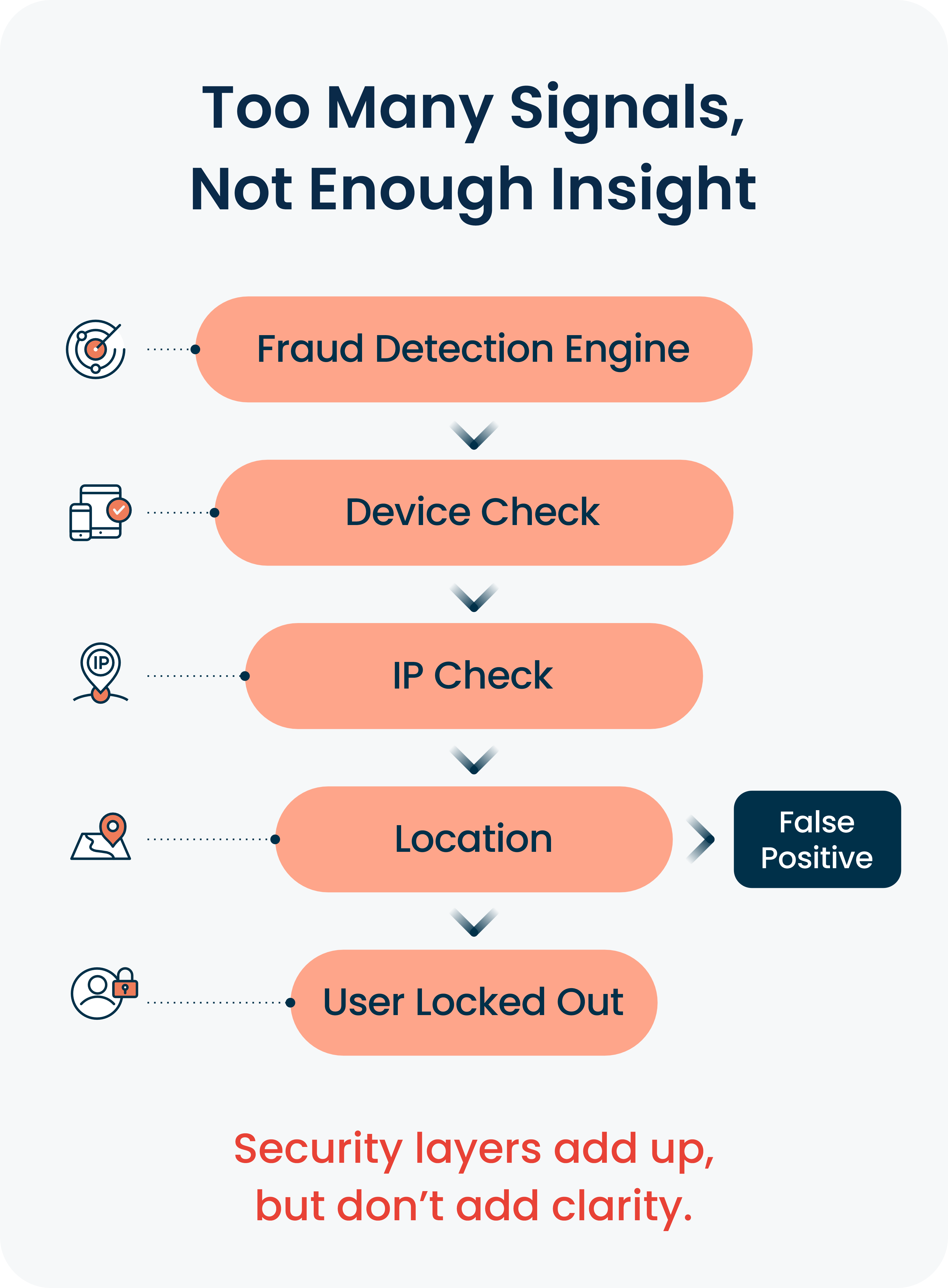

Fraud detection engines verify user identity purely at the device level. Most fraud detection systems rely heavily on statistical models and real-time signals to decide what’s safe and what’s suspicious.

They scan for things like new IP addresses, device changes, and odd transaction timing and trigger extra verification steps when something looks off.

Even though there are multiple authentication steps before a user can access their account, the actual improvement in security is not as big as it appears.

Risk scores from fraud detection engines don’t reflect reality. That’s why they generate huge volumes of signals and false positives.

Legitimate users constantly get flagged, locked out, or slowed down because the system thinks something unusual might be happening.

These unwanted outcomes are costly. They drive up operational expenses and frustrate users.

More Layers of Fraud Detection Doesn't Mean More Security

The type of fraud detection engines present in most mobile banking apps may reduce fraud and meet minimum regulatory requirements, but it does not eliminate it. Fraudsters are still winning.

New methods of MFA bypass keep appearing in the wild:

SIM swapping attacks to intercept one-time passwords

MFA fatigue attacks that bombard users with verification requests until they accidentally approve one

Sophisticated phishing that mimics legitimate login pages

Mobile banking apps that only look at device-level signals rather than linking actual user identity to transactions are essentially fighting yesterday's battle with yesterday's tools.

And who pays the price? Your customers.

Customer UX Suffers As a Result

OLet's look at what happens from the customer's perspective. Anyone who's used OTP verification has experienced at least some of these frustrations:

Codes that arrive too late (or never arrive at all)

Messages caught in spam filters

Authentication that fails when traveling internationally

When these technical hiccups occur, users don't just wait patiently—they get frustrated, abandon transactions, and sometimes even switch banks.

It's also surprisingly common for banking apps to force users to re-authenticate for what should be simple actions (like viewing a slightly longer transaction history), creating a cumbersome experience experience with multiple friction points:

Increased login times while waiting for verification codes

Authentication that depends entirely on having a second device available

SMS codes that are neither secure nor reliable

Device-specific usability problems like tiny input fields or the need to switch between apps

Error-prone workflows that can trigger account lockouts after just a few mistakes

Technical hiccups = frustration = dropped transactions.

It's also common for mobile banking apps to force users to constantly re-authenticate to do what seem like basic transactions (e.g., checking their balance for the past six months instead of three months creates a new password request).

The result for the customer is a cumbersome authentication flow that directly creates points of friction like:

Increased login times. Users have to wait for a verification code. If it’s delayed or doesn’t arrive, they have to start over or request another code.

Authentication that relies on a secondary device. If that device is turned off, left at home, or out of battery, the user may be locked out of their account. Many systems don’t offer fallback options.

SMS codes that carry their own risks. SMS codes are vulnerable to SIM swap attacks, forwarding scams, and malware. Despite this, many banks still rely on them, even though they’re not secure or reliable.

Device usability problems. Small screens, hard-to-tap fields, and the need to switch apps just to retrieve a code make the process slow and error-prone. For older users, this can be a major barrier.

Error-prone workflows. Users mistype codes or miss the time window, and just a few failed attempts can trigger a lockout. Getting back into their accounts may require resetting credentials or calling customer support.

These interruptions have consequences. They create a fundamental source of friction and pain for your users.

These aren't minor inconveniences—they're fundamental barriers to a good user experience. One survey found that 62% of consumers don't want to verify their identity every single time they pay for something.

The harsh reality? Users won't thank you for robust security if it means they can't easily access their accounts.

Why “Something You Are” Is the Best Balance Between Security and Convenience

An unfortunate alternative for many frustrated users can be to turn off or simply not even adopt 2FA.

The problem is not necessarily with 2FA itself but more with how many banks and other businesses implement it. First of all, multi-factor authentication requires one of the following:

Something you know: A passcode, password, user number, or memorable word.

Something you have: A smartphone or device that receives verification codes

Something you are: A biometric such as your fingerprint, facial features, or retina.

Something you know relies on the user creating and remembering a “secret.” Consumers typically use many different sites and apps, so it can be difficult and cumbersome to keep track of login credentials for each one.

As a result, passwords are often simplified and used for multiple sites and apps, greatly weakening a user's overall cyber security.

Something you have can be easier to manage, but it relies on the user having access to the right device. It also creates opportunities for bad actors to take over a device via SIM swaps and other techniques.

Something you are is the most convenient as a user does not need to remember information or have access to hardware.

Here are the different mobile banking app 2FA implementation options at a glance:

2FA type | Description | User Experience Impact |

Something you know | Passwords, PINs, security questions | High. Difficult to manage across many apps and sites; users often forget or reuse credentials. |

Something you have | A device that receives verification codes | Moderate. Depends on access to a secondary device; issues if device is unavailable, lost, or out of battery. |

Something you are | A biometric, such as a fingerprint, face scan, or retina. | Low. Very convenient and fast; no need to remember anything or switch devices. |

Why Biometrics Create Both Better Security and Better UX

Because of its simplicity for the user, the something you are approach is emerging as the best solution for providing both reliable security and minimal friction for users.

An example of the something you are approach is biometric authentication. It uses an individual’s unique features, such as fingerprints or face scans, to confirm their identity.

Unlike codes that can be stolen, a user’s biometrics are much harder for criminals to compromise.

In addition, this solution generates very little friction for users, and nearly all modern consumer devices support fingerprint scanning and include cameras that can be used for facial recognition.

Continuous Fraud Prevention with Zero User Interruptions

Many biometric authentication methods are used only at the sign-in stage and not throughout the entire online session. As a result, criminals can use photos, videos, or voice recordings to impersonate a user and gain access to their account.

Detecting a user’s presence or liveness can ensure the biometric information is coming from the authorized user. Combining biometrics with liveness detection (as well as 2FA) helps achieve a high level of security with a frictionless user experience for your customers.

With this approach, a user’s biometric markers, combined with keystroke patterns, mouse movement, physical location, or device characteristics serve as a virtually invisible secondary authentication factor.

Enabling 2FA in the background allows a user to bank, shop, and access accounts without entering codes or providing other verification.

Making Banking Both Safer and Easier

For too long, we've accepted the false choice between security and usability. Modern biometric technology proves we can have both—enabling real-time authentication that's both more secure and completely unobtrusive.

The result? Higher security, happier customers, and fewer abandoned transactions. Your users get to focus on what they actually came to do, not on proving they are who they say they are.

Proper application of biometric technology enables a secure and uninterrupted experience thanks to real-time authentication and invisible MFAs that remove all interruptions from the customer journey.

Ready to see how this approach could transform your mobile banking experience? Get a demo of IronVest today and discover what truly frictionless security looks like.